Korea Digital Marketing 2021

22 Dec , 2021

With its prosperous economic growth and advanced digital technologies, Korea’s digital market is full of charm for marketers to tap into. In 2019, the country ranked 3rd worldwide by its online retail sales, and its B2C ecommerce market contributed nearly a quarter of the country’s overall retail sales. From 2019 to 2021, Korea’s digital advertising spend has seen a significant US$1.2 billion increase. Not only thriving, Korea continues to expand the digital marketing pie with full momentum.

In this article, we’re going to raise the curtain of Korea’s digital marketing landscape, as well as the hot digital marketing trends and prospects in Korea that help you stand out in the valuable market.

Digital Marketing Landscape in Korea

Most Popular Digital Marketing Platforms in Korea

Search Engine Marketing in Korea

Digital Marketing Opportunities in Korea

Digital Marketing Landscape in Korea

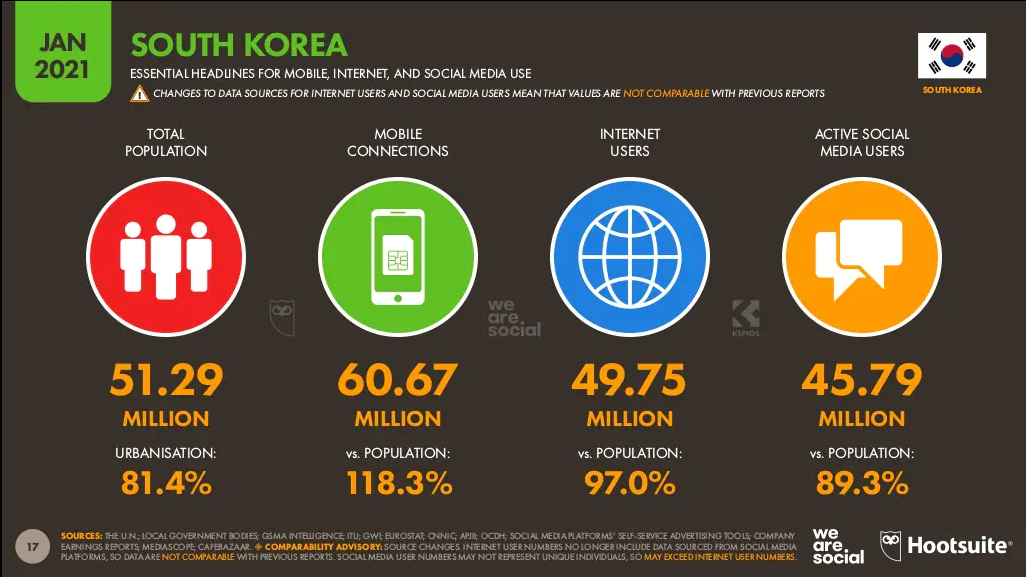

South Korea, with its 51.29 million population, attains an 81.4% urbanization rate. 97% of Koreans are internet users, along with 45.79 million active social media users, accounting for 89.3% of the population.

Korea’s digital marketing landscape

Korea’s digital marketing landscape

Every day, Korean netizens spend 5 hours 37 minutes on the internet on average, counting 2 hours 51 minutes on videos (broadcast and streaming) and 1 hour 8 minutes on social media.

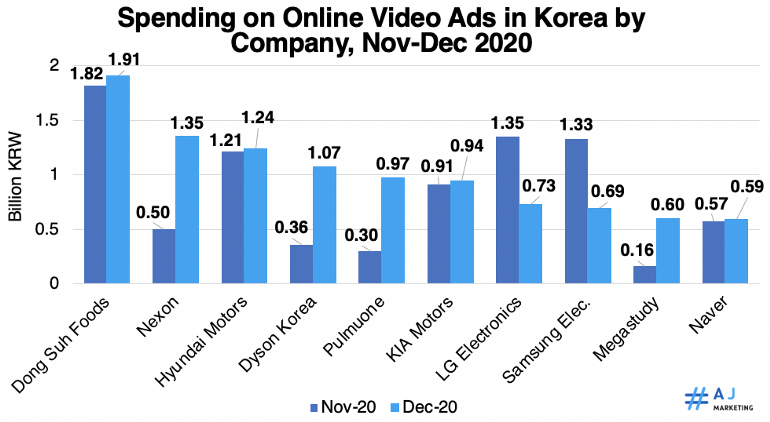

With video being the main content format consumed by Koreans, local and international brands in Korea, such as Dong Suh Foods, Hyundai Motors, Samsung and LG Electronics, have incorporated video marketing as key strategy into their marketing plan. The spending on online video ads in Korea has also reached 616.6 billion KRW in the second half of 2020, with YouTube being the most favored media platform.

Spending on Online Video Ads in Korea by Company, Nov-Dec 2020

Spending on Online Video Ads in Korea by Company, Nov-Dec 2020

Insight: In Korea, the consumption of online videos has long surpassed traditional TV watching, with more than half happens on mobile devices. Research also shows that video viewers are 20X less likely to be distracted from their mobile screen when watching videos than TV, and more inclined to search for product information after watching mobile video ad.

Since video consumption pattern is becoming more mobile-friendly, short video content is suggested to engage the on-the-go mobile users. Studies reveal that short videos of less than two minutes make up 73% of all video ads. Dongwon, a Korean food maker, created a 41s video ad to promote its canned tuna. Its ‘Taste’s Great Tuna Campaign’ video ad has generated more than 15 million views in one month.

Dongwon’s ‘Taste’s Great Tuna Campaign’ video ad

Dongwon’s ‘Taste’s Great Tuna Campaign’ video ad

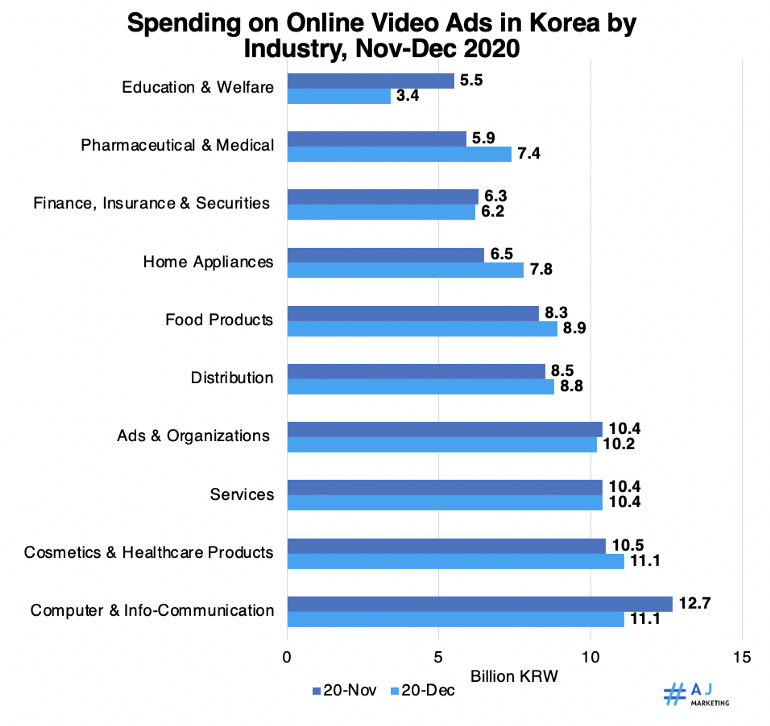

Among the industries which increased the most ad spend on online video advertising at the end of 2020 was “Education & Welfare”, with a growth rate of 61.8%; while “Cosmetics” and “Computer” industries spent the most money on the ad format. Overall, mobile video ads and short video content are definitely key trends to embrace to ensure your business success in Korea.

Spending on Online Video Ads in Korea by Industry, Nov-Dec 2020

Spending on Online Video Ads in Korea by Industry, Nov-Dec 2020

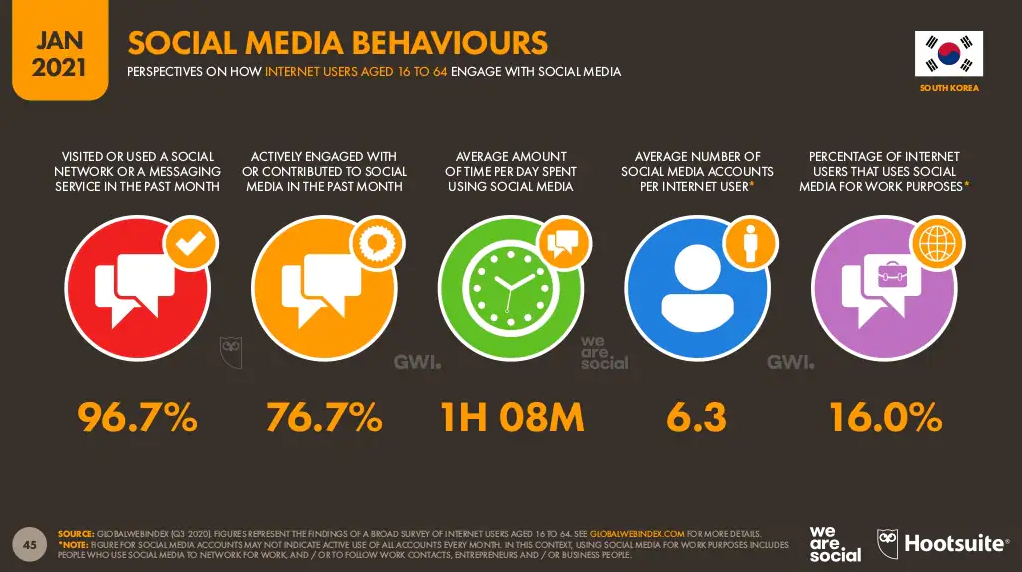

Tapping into social media behaviours, it’s worth noting that South Korea has the world’s second highest rate of active social media users as of April 2021. Among the Korean internet users, 96.7% of them use social networking or messaging, which demonstrates significant digital marketing potential in social media marketing for businesses to broaden further in Korea. Brands can engage and connect with Korean consumers through creating a branded online community, by creating appealing contents or tailored messages that most likely resonate with them.

Korea’s social media behaviours

Korea’s social media behaviours

Most Popular Digital Marketing Platforms in Korea

Most-Used Social Media Platforms in Korea

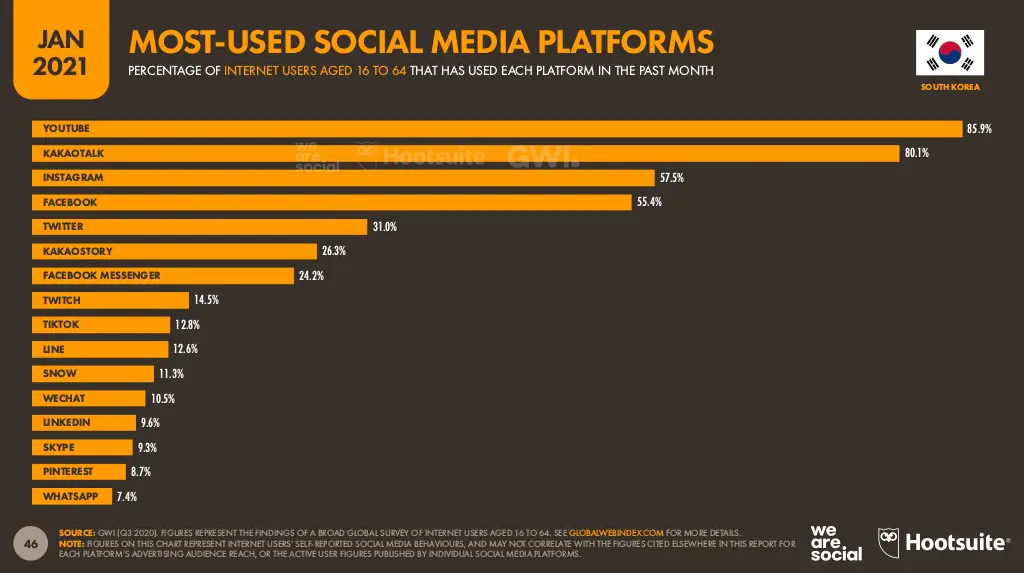

Korea’s most used social media platforms are YouTube, with 85.9% of penetration rate, followed by KakaoTalk (80.1%), Instagram (57.5%), and Facebook (55.4%).

Korea’s most-used social media platforms

Korea’s most-used social media platforms

YouTube

YouTube is the most popular social media platform in Korea. Each month, Koreans consume nearly 39 hours on YouTube. While Korea is known for its cosmetics, fashion, K-pop, and K-dramas, the diversity allows marketers to collaborate with KOLs from related industries to design YouTube marketing strategies that are tailored to local consumers. Korean YouTube creators have recently become more polarized, generating videos ranging from authentic daily vlogs to well-planned videos aimed at different interests. Audiences are more likely to feel connected and genuine if you partner with Korean YouTube creators who fit your brand's image.

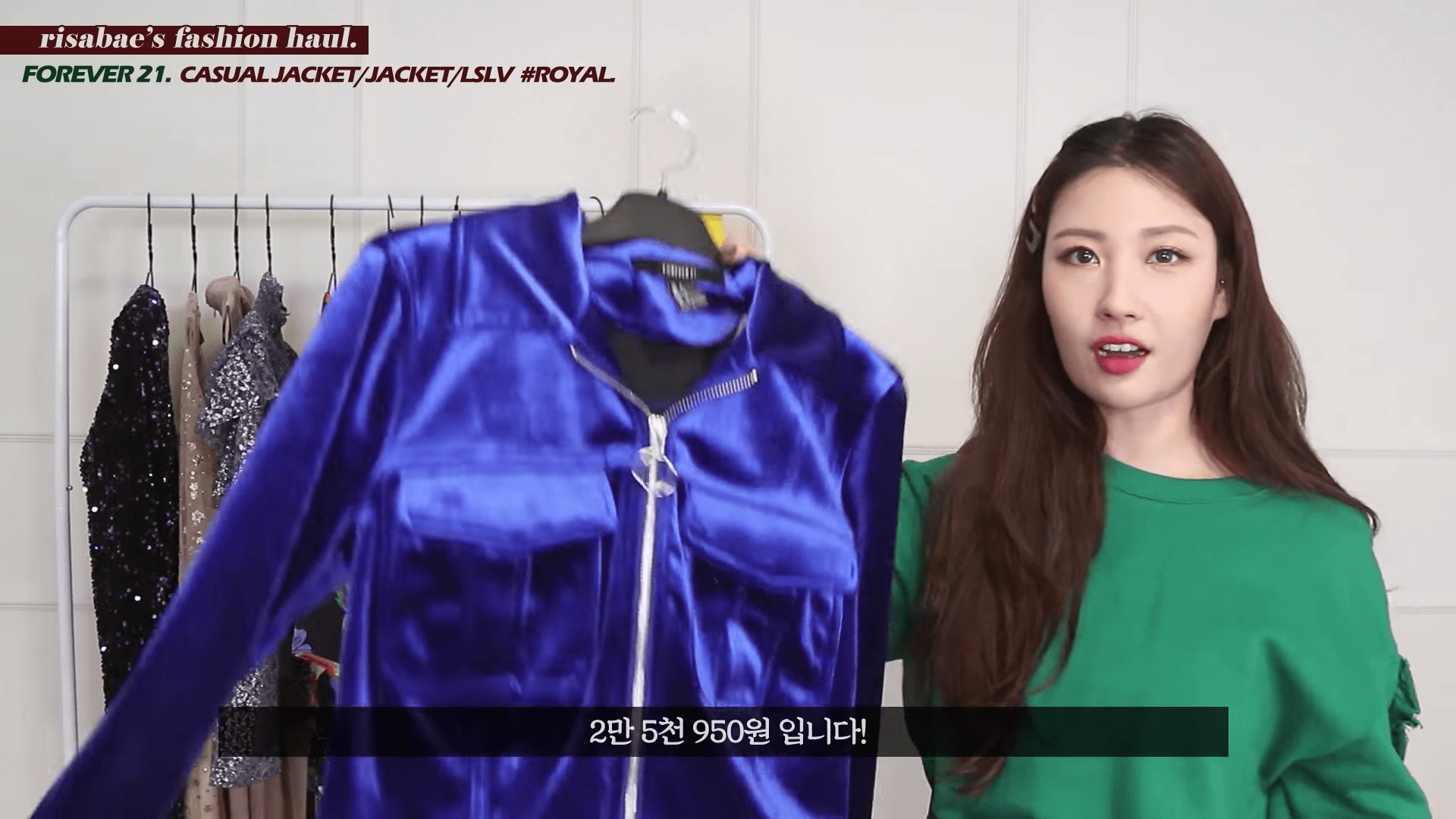

Forever 21 and Zara, for example, cooperated with Korean YouTuber Risa Bae. With over 2 million subscribers, she is Korea's second most popular beauty YouTuber. In the video, Risa Bae displayed her latest Forever 21 and Zara apparels while expressing her liking for both brands and relevant pricing information. It raises awareness for both brands within her followers, which is primarily made up of people fond of K-beauty or K-culture. By which, the video received 851,000 views, significantly enhancing the brand’s visibility and familiarity for Korean consumers.

Forever 21 x Zara x Risa Bae’s video

Forever 21 x Zara x Risa Bae’s video

KakaoTalk & Kakao Story

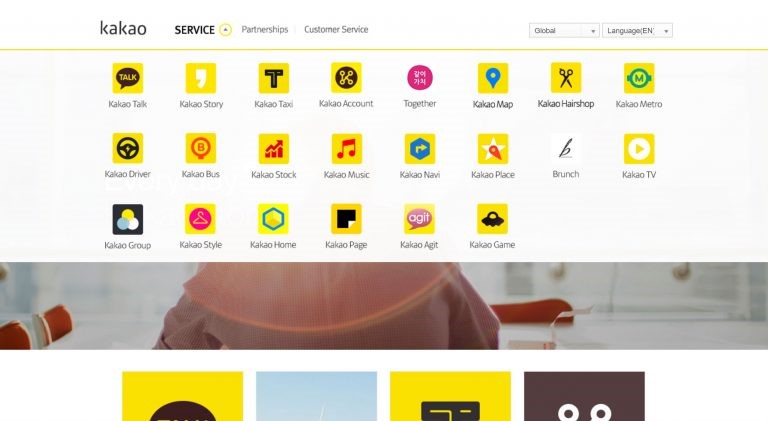

KakaoTalk is South Korea's most popular social communication app, upholding 96% of the social media messaging market share. The monthly active users on KakaoTalk has boasted over 45 million. The app has become ingrained in Koreans’ daily life, and it has since evolved into a superapp that offers a variety of daily functions and services, including KakaoStory, finance, ecommerce, music, taxi-hailing service, trip planners, and payment functions.

KakaoTalk’s functions

KakaoTalk’s functions

Exploring into KakaoStory, it’s a photo-centric SNS launched by KakaoTalk that allows users to share photos and thoughts, and is installed on 98% of the Korean population’s smartphones. Females in their teens to the 40s make up the majority of its users. Photo editing, blogging, hashtags, and a news feed where ads can be displayed are all key features.

Very much as other digital marketing platforms, KakaoTalk offers a variety of ad formats, such as banner ads, Kakao channel, smart SMS, bizboard, and story ads. The app serves as a medium for connecting Korea’s vast audience, who have embedded KakaoTalk into their daily essentials.

Instagram is the most popular lifestyle sharing platform in Korea, with over 16 million Instagram users in Korea. As of October 2020, it had amounted to 3.4 million monthly active users in South Korea. The largest user group, aged 25 to 34, accounted for 35% of the population, followed by the 18 to 24 age group, which accounted for 27.5% of the population. When it comes to raising awareness or targeting a younger audience group in Korea, Instagram would be the ideal social site to engage in.

_419923.png) Korea’s Instagram users by gender (Sept 2021)

Korea’s Instagram users by gender (Sept 2021)

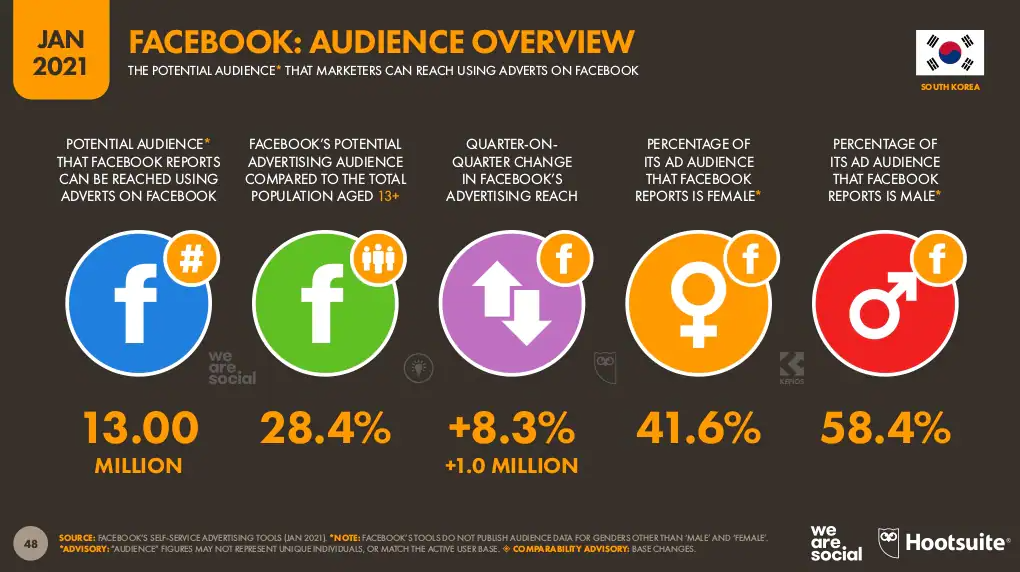

Facebook, being the world’s largest social networking site, has the potential to reach 13 million Facebook users in South Korea through ads. In comparison to other social media platforms, it’s worth noting that Facebook is more popular among male users in Korea, with roughly 60% of ad audience being male, although varying with industries.

Korea’s Facebook audience overview

Korea’s Facebook audience overview

Cyworld

Compared with other social networking platforms, Cyworld might sound stranger to the non-locals. It’s a Sims-like social networking platform that allows members to form friendships, share daily life, and interact with other users by using Avatars in the “mini-rooms” on the platform. Cyworld had over 32 million users at its peak. During its business shutdown in 2019, it still had 11 million users. This year, Cyworld is set to relaunch. Due to the expanding popularity of "Sims" in Korea, marketers may need to be aware of the platform, as it could create a surprising digital marketing opportunity.

Cyworld user interface

Cyworld user interface

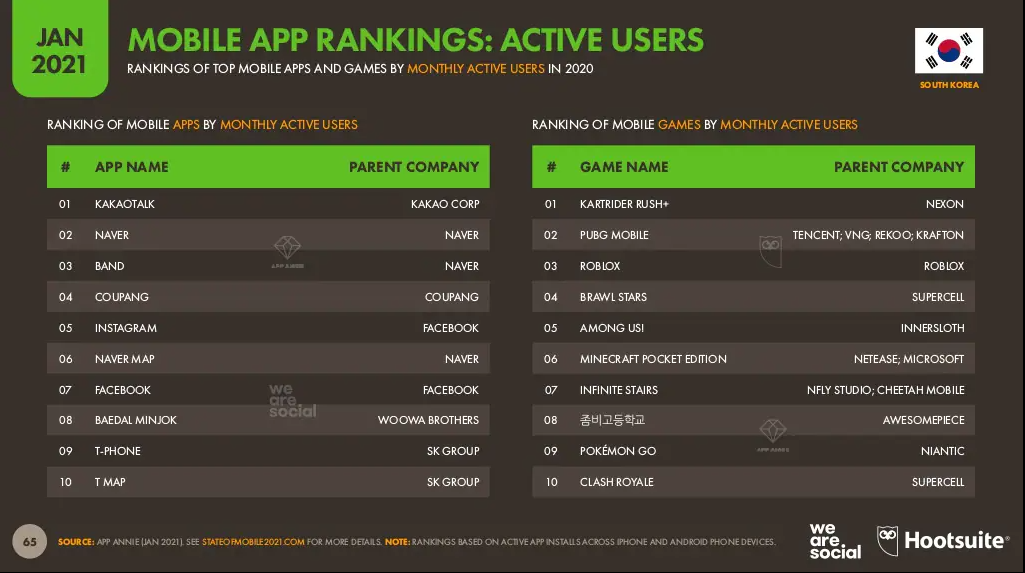

Most Used Mobile Apps in Korea

Korea is a nation connected by mobile Internet. Local service providers hold a large market share and there is indeed keen competition. For example, international ride-sharing company Uber can’t beat local competitors like Kakao Talk, T Map and Tada. In terms of the most used mobile apps in Korea, they are KakaoTalk, Naver, BAND, Coupang, and Instagram.

Korea’s mobile app rankings

Korea’s mobile app rankings

BAND

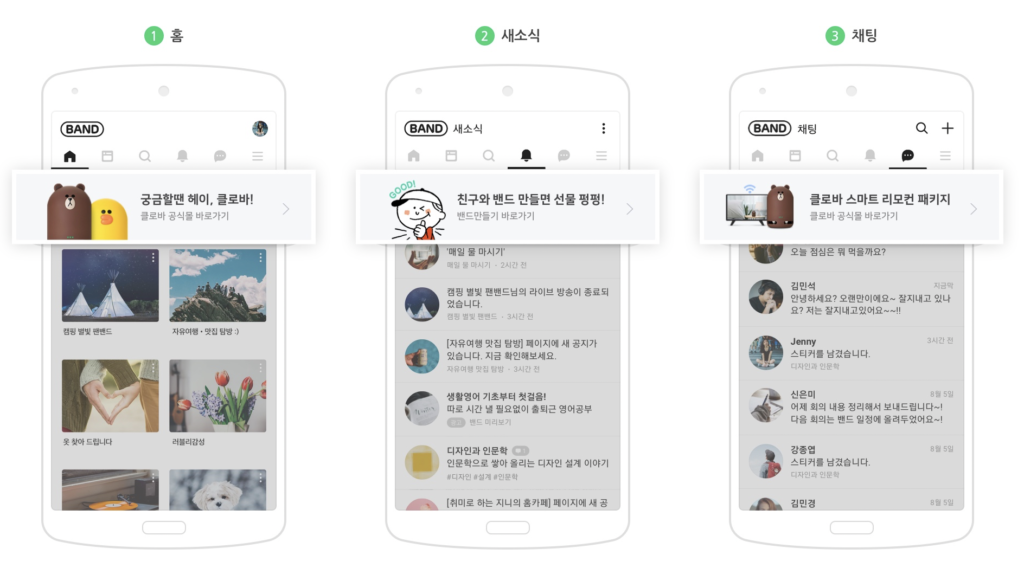

BAND, under Naver Corporation, is a social mobile app in Korea that facilitates a dedicated space for group and community-related communication. Users can create and join separate spaces or “bands”, and also access to the community board, share calendar, polls, to-do lists, and private chat. It has reached 16 million users in 2020. An interesting fact is, BAND is especially popular among those in the 50s, accounting for 58.5% of social media users. In contrast, only 7.8% is in their twenties.

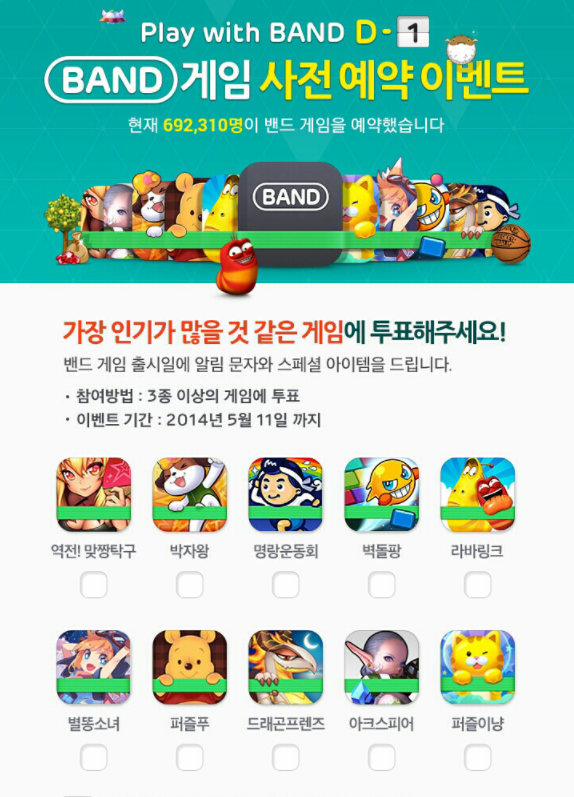

In addition, its gaming platform that rolls out additional ten games every two weeks has substantially increased the popularity of the app in Korea. Differ from other gaming platforms, BAND gaming is distinctively targeting men in their 40s. Hence, for marketers looking to connect with a middle-aged population, BAND could be your consideration. The ad formats include full-screen app exit ad, smart channel, reminder ads, and new news advertising etc.

BAND’s Smart Channel

BAND’s Smart Channel

Naver Band’s gaming platform

Naver Band’s gaming platform

Coupang

Coupang, also known as the “Korean Amazon”, is one of South Korea’s popular ecommerce platforms. Praising to its “rocket delivery” service, Coupang has attained over 14 million active users in 2021. Korean netizens are so enthusiastic about online shopping that approximately 76% of them have visited an ecommerce site before, indicating the site’s capacity to reach a broad audience.

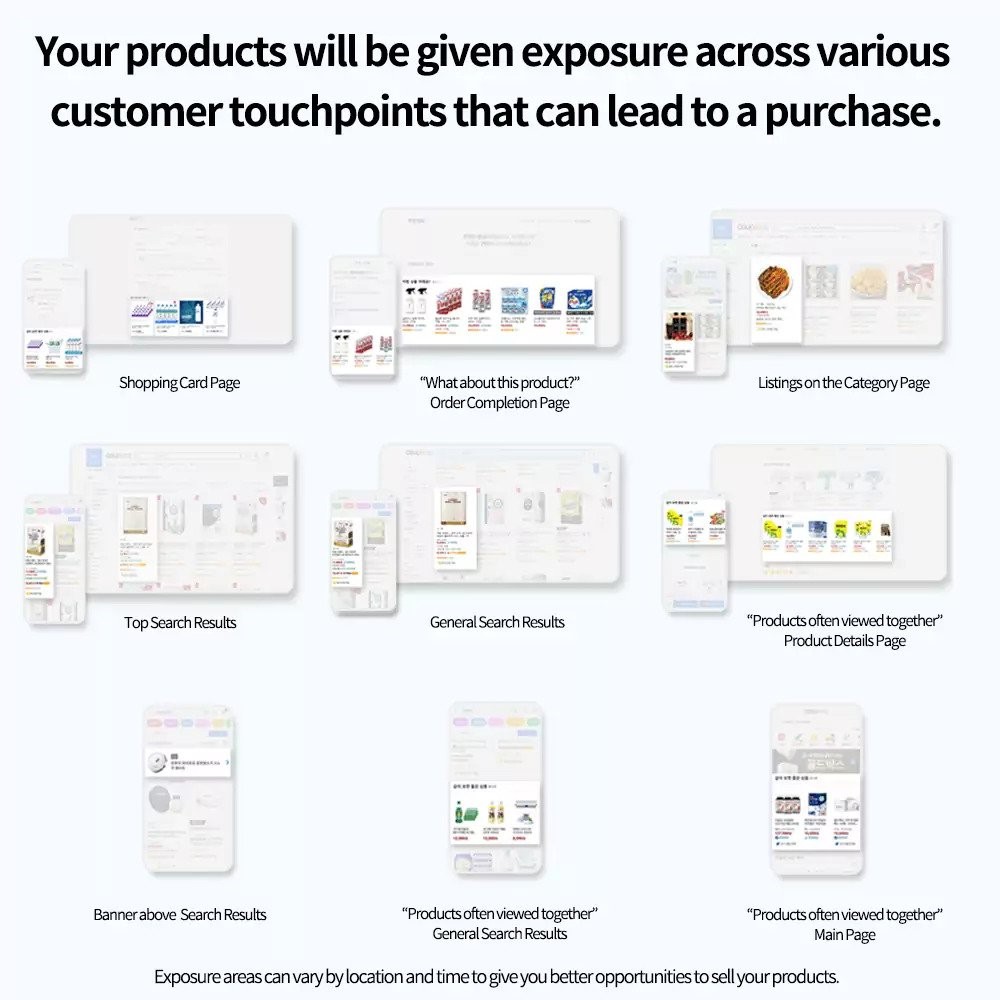

If you look deeply at Coupang, you’ll see that ads appear on practically every page, including the “Category”, search results and shopping cart pages, and even the order completion page. Apparently, Coupang provides a considerate number of placements for marketers to expose or drive conversions. With AsiaPac’s service and extensive ecommerce marketing experience, we will assist you in collecting relevant product data and generating compelling creatives, maximizing your ad performance.

Coupang’s ad placements

Coupang’s ad placements

Search Engine Marketing in Korea

Like many other countries, Korea netizens use search engines as their primary sources for new brand discovery and 54.8% of them use it for brand research. With Google still occupying a significant 36% of search engine market share in Korea, it’s also time to learn more about the two search engines that target Koreans specifically: Naver and Daum.

Naver

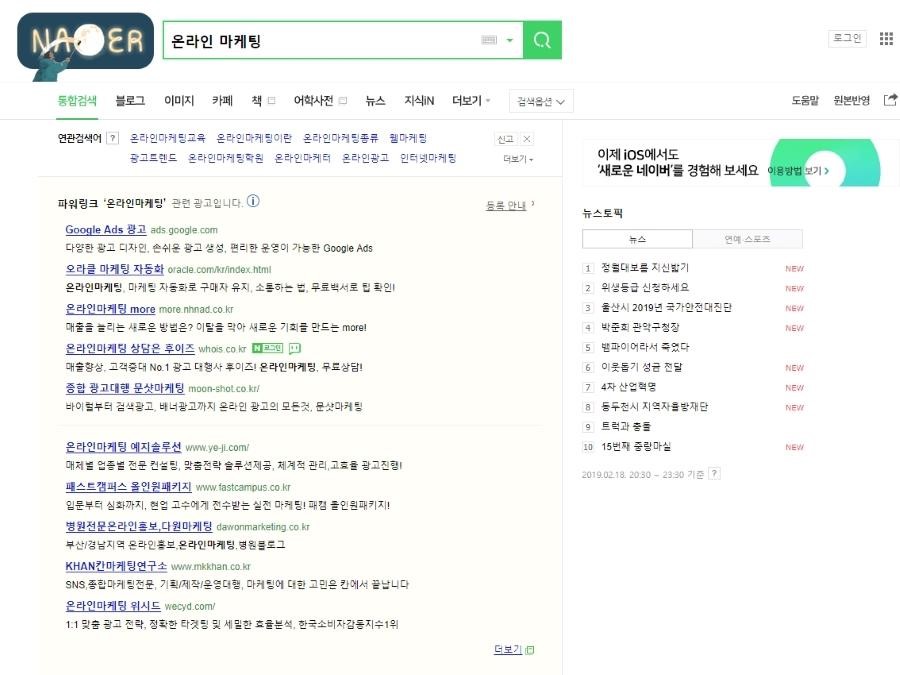

Naver is Korea’s largest search engine, with a market share of 59% (yes, surpassed Google). Naver’s search results are much localized. Instead of crawling every webpage in the world, its search algorithm is tailored on the Korean language and gives more relevant results.

Search Engine Marketing (SEM) is highly encouraged on Naver. Since Naver has multiple ad placements on its SERP, organic results are limited on the search result page, with lots of user generated content from Naver’s own services like Naver Blog, Naver Café (like Facebook Group) and Naver Q&A. Naver’s search engine offers various ad types, such as display ads, brand search ads, keyword ads, shopping ads, Naver blog ads etc. But if digital marketers want to go for a synergy of SEM and SEO marketing, you can develop your profile on Naver blog to outrank your website to increase search visibility.

Naver’s SERP

Naver’s SERP

Daum

Merged with KaKao in 2014, Daum holds a 7.72% share of the Korean search engine market. Daum also has a large user base of Koreans in their 30s and 40s. Ads in Daum are comparable to those in Naver and include blogs, cafes, reviews, Q&A, video, images, and shopping results. What distinguishes Daum from Naver is that Daum's search results are not confined to Korean. It also provides mobile app tracking and retargeting to help with audience targeting. Rather than just showing text for brand search, it also offers images, giving the audience a deeper concept of the brand.

Daum’s site

Daum’s site

Digital Marketing Opportunities in Korea

1. Video marketing in Korea

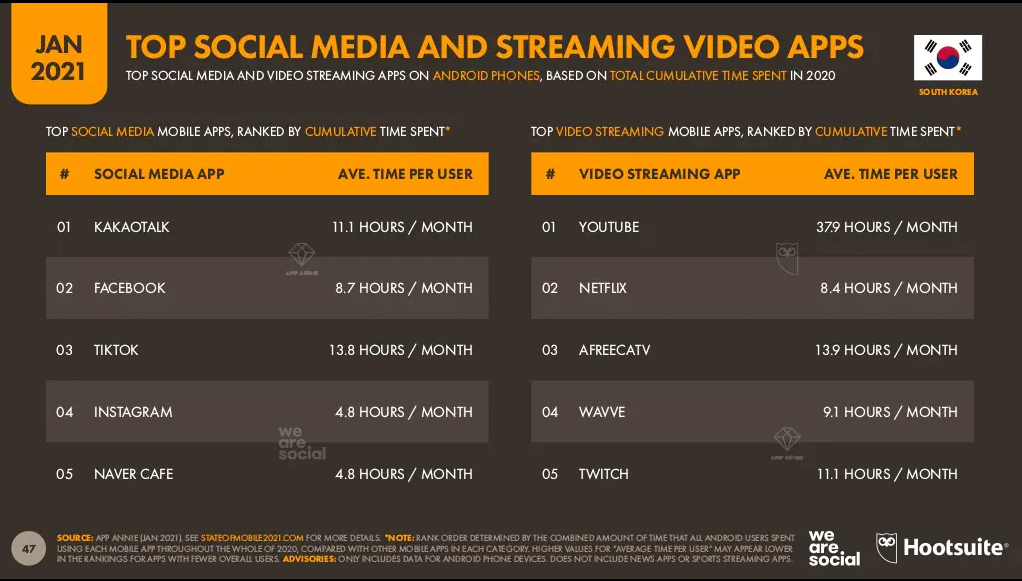

Video marketing is all the rage these day. With videos – especially short videos – being the most sought-after content type among Koreans and the amount of time they spent on watching videos, it’s obvious that it could be a dominant digital marketing strategy in Korea. Meanwhile, video-based platforms like YouTube, AfreecaTV, and Twitch have grown in popularity and become a pillar of Koreans’ online video consumption.

With its bi-directional nature, video marketing has emerged as an immensely strong tool for forging audience connections and evoking positive emotions. Brands are encouraged to work with KOLs in uplifting their video marketing efforts, for example create "unboxing" or testimonial videos, as Korean consumers enjoy polished content made by their idols.

Digging deeper into KOL marketing in Korea, partnering with Korean celebrities, also known as top tier KOLs or mega-KOLs, is especially motivated. Thanks to K-dramas and K-pop fever, the fandom culture in Korea is enormous. Marketers can collaborate with Korean idols to have them appeared in your brand ad and promote your products or services, giving brands a direct line to youthful Korean audiences and broaden brand awareness. Furthermore, given the global interest in Korean cosmetics and fashion, brands can work with mid-tier or micro-KOLs who are active on Instagram or YouTube to promote their offerings. In addition to KOL’s already-developed fan base, your brand videos have a better possibility of going viral.

Korea’s top social media and streaming video apps

Korea’s top social media and streaming video apps

2. Webtoon advertising in Korea

Webtoon is growing popularity in Korea at the moment. It is digital comic with cuts and illustrations for a digital platform. In Korea, a few Webtoon platforms, such as Naver Webtoon, Daum Webtoon, Lezhin, dominate the market. The Webtoon market has expanded to 1 trillon KRW as of 2020, and is expected to grow continually. Every day, 8 million Koreans are believed to browse Naver Webtoon.

While intentional marketing messages are generally avoided by consumers, commercial messages included in Webtoon authors’ work are usually accepted by readers. The positive perception of the Webtoon is supposed to be transferred to the brand or product, resulting in a favourable consumer attitude towards the brand. Marketers can use image type product placement (PPL), content inserted PPL, or brand webtoons to promote their brands and accordingly, raise brand awareness.

Korean Webtoon’s content inserted PPL

Korean Webtoon’s content inserted PPL

3. Buzz and forum marketing in Korea

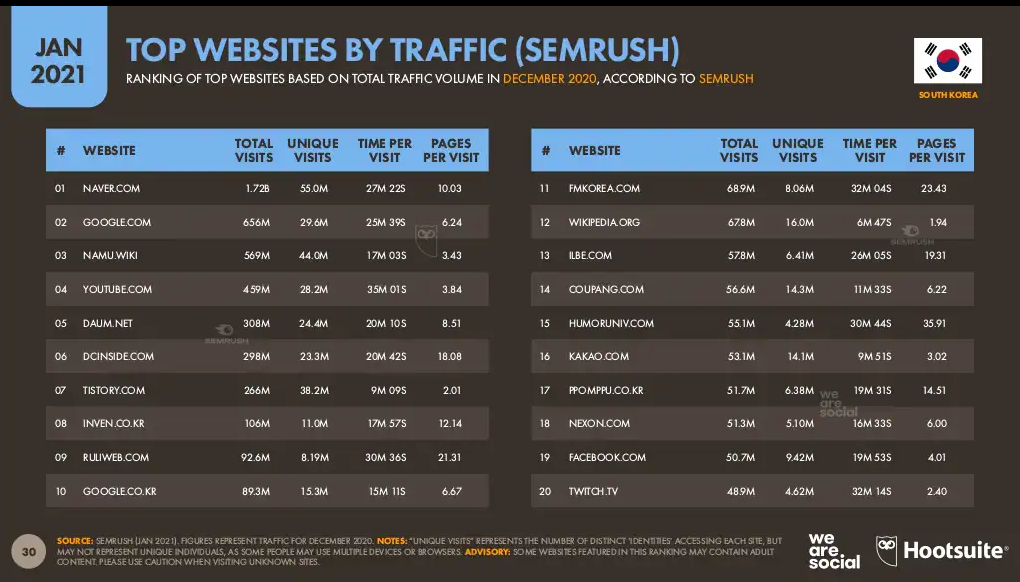

The value of forum always lies in the diversity and authenticity of its content, as well as offering a central medium for people to ask questions and share their opinions. Namu.wiki, Daum.net, Dcinside.com, Tistory.com, and Ruliweb.com are all in the top 10 most frequently visited websites in Korea. All of these websites have buzz marketing features, such as forums and blogs that promote community-driven knowledge, information, and interaction. Given the fact that Korean netizens are especially active on forums and blogs, marketers may tap into forum marketing to cultivate their online community and engage with the specialized audience.

Selecting the right forum to develop content topics about your products and interact with audiences can help you reach your niche in similar backgrounds, experiences, or even cultures, and encourage them to discuss around your content and become involved in your community. More website traffic, more backlinks, better brand exposure, and higher conversion rates can all be obtained by engaging in the appropriate forum and creating the most relevant content topic.

Korea’s top websites by traffic

Korea’s top websites by traffic

Summary of Digital Marketing in Korea

Korea is honoured as one of the world’s most technologically advanced nations, boasting the fastest internet connection. In addition to its high internet usage rate and stable economy, Korea is a tempting market for brands to enter and grab a slice of the pie. Webtoon, video, and forum marketing are critical digital marketing strategies that cannot be missed to succeed in this industry. If you’re looking to seize a strong presence in the Korean market, click here to contact us now!

About AsiaPac Net Media

With an extensive digital marketing experience of serving more than 2,500 clients across Asia in sectors such as ecommerce, finance, gaming, travel, retail, beauty, FMCG, education, health products etc., AsiaPac’s expert team is highly recognized for the excellence in providing performance-driven services to businesses across Asia, and global corporates targeting Asia markets. If you’d like to learn more about AsiaPac and the work we’ve done, visit our Cases page. For more information on AsiaPac/ AdTech and our services, please contact us at info@asiapac.com.hk/ info@adtechinno.com.